Courtesy Pay helps protect you against having your checks returned in the event of an inadvertent overdraft of your account. This services gives you a reserve for emergencies or unexpected situations. There is no fee for having this privilege on your account and you're only charged if you overdraw your account. You don't have Courtesy Pay on your account until you receive written confirmation from us that it has been added.

Here is how Courtesy Pay works for you:

Courtesy Pay is not a line of credit. However, if you overdraw your account, we will normally pay the overdraft, subject to the limit of your Courtesy Pay.

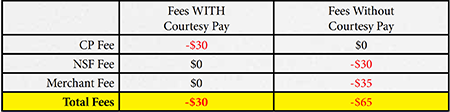

For example, suppose you do not have Courtesy Pay and your account balance is $50. If you write a $100 check, we will charge your account a fee for writing a check with insufficient funds. This fee is currently $30. The check will then be returned. In most cases, the establishment that you wrote the check to will require you to redeem the check. You will also probably be charged a fee by that company (usually around $35) for writing an NSF check. You've now incurred two fees ($30 at McCoy and $35 at the merchant) for a check that wasn’t even paid.

However, if you have Courtesy Pay, here is how the situation typically would have worked. When the check arrived, the Credit Union would pay the check and charge you the $30 overdraft transaction fee. The total charge would've been $30 compared to $30 PLUS $35 in merchant fees if you didn't have Courtesy Pay. Additionally, you avoid being added to any bad checklists on the check approval networks or with the merchant.

When you use your Courtesy Pay you must remember to subtract the overdraft fee from your account balance. In the example, $130 would've been from your account: $100 (the check amount) PLUS $30 (the overdraft fee amount). Any item that comes in while your account has a negative balance will be charged the $30 overdraft fee. It is important to record these fees. Your next deposit will bring your balance to the deposit amount minus the overdrawn amount and the overdraft fee.

Potential Savings of $35 with Courtesy Pay

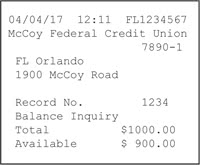

ATM receipts, and other ways that provide available balance information, will show your current available balance, NOT including Courtesy Pay.

Understanding your ATM Receipt

The Available Balance that's listed is the total balance minus any check holds or point of sale holds placed on your account. The available balance does not reflect any Courtesy Pay amount.

The balance shown on the ATM Receipt is the LEDGER BALANCE, which does NOT include any Courtesy Pay amount.

Points to Remember about Courtesy Pay

Every debit item on an overdrawn account will be charged an overdraft fee of $30.

You must promptly repay the amount of the overdraft and the overdraft fee.

If the account isn't in good standing, it'll be automatically removed from Courtesy Pay during the systems daily processing routine.

If the account has a child support freeze (or other issue) it will be manually removed from Courtesy Pay.

Standard Courtesy Pay is available for overdrafts that result from checks, over-the-counter withdrawals, and electronic debits (ACH) to your account.

You must consent to Courtesy Pay Plus for McCoy to pay debit card transactions and ATM withdrawals using Courtesy Pay.

You must decline Courtesy Pay Plus to pass on McCoy paying debit card transactions and ATM withdrawals using Courtesy Pay.

If you currently have Courtesy Pay Plus and no longer want it, you must revoke your consent for the service.

You may consent, decline or revoke Courtesy Pay Plus by calling 407-855-5452 or 1-888-584-7701 (toll-free), or online at our website.

Courtesy Pay does not interfere with any form of overdraft protection you already have available on your account. Any other form of overdraft protection you already have established will be applied before Courtesy Pay.

Courtesy Pay Terms and Conditions

You must maintain your account in good standing, which includes at least:

- Bringing your account balance to a positive balance

- Not being in default on any loan or other obligation to

- McCoy Federal Credit Union and

- Not being subject to any legal or administrative order or levy.

Please see our Courtesy Pay Disclosure Information for terms and conditions.

Courtesy Pay Disclosure

Authorize Courtesy Pay online

Download the Authorization Form (PDF)